- Coca-Cola transformation is making it a more profitable and asset-light business with more resources to reinvest in its strong brands.

- The transition has also made the company's industry leading return on equity more resistant to declines in sales.

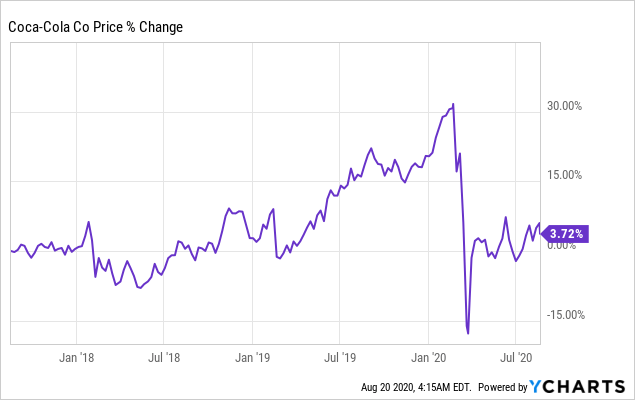

- Short-term shocks due to pandemic closures brought valuation back to attractive levels relative to long-term business fundamentals.

Coca-Cola Company (KO) has created one of the strongest beverage brand portfolios globally. This in combination with the company's unique franchise business model makes KO one of the most profitable consumer staple companies ever.

By divesting its bottling operations, KO is also moving up on the value-added chain and better positioning itself to reinvest more in its key brands and make a strong push into higher margin product segments, such as coffee.

Due to its high exposure to bars and restaurants, the pandemic closures had a significant short-term impact, erasing entire 2019 gains.

Data by YCharts

Data by YChartsThe lower valuation due to transitional factors, combined with Coca-Cola's stronger positioning and focus on high margin segments make the company an attractive long-term holding for a consumer staples portfolio.